Payvessel Quickstart Guide

Chart your integration course before setting sail with Payvessel. To integrate Payvessel into your application, follow this step-by-step navigation guide.⚡ Fast Setup

Get up and running in minutes with our streamlined onboarding

🔒 Secure Testing

Test safely in our sandbox environment with no real money

🏗️ Step 1: Create Your Developer Account

Sign up for a free developer account to access our sandbox environment where you can safely test all features without real money.

- 💳 Process payments using test card data and mock accounts

- 🏦 Simulate bank transfers and mobile money transactions

- 🔔 Test webhooks and error scenarios

- ✅ Validate customer identification processes

⚙️ Step 2: Configure Your Integration

Choose your integration vessel based on your technical stack and business needs:Payvessel Checkout

Use our pre-built, optimized payment UI for quick implementation

SDKs & Plugins

Leverage our libraries for popular frameworks and platforms

Direct API Integration

Build custom payment flows using our flexible endpoints

Testing Best Practices

Testing Best Practices

- Use our comprehensive test card numbers

- Validate all error scenarios

- Test webhook endpoints thoroughly

- Verify mobile money simulations

Integration Patterns

Integration Patterns

- Single payment flows

- Subscription billing

- Multi-party transactions

- Mobile-first implementations

🚀 Step 3: Launch Your Live Account

After successful testing, upgrade to a production account to access real transaction processing capabilities and actual fund movements.📋 Step 4: Complete Business Verification

To begin live transactions, you’ll need to complete our verification process, which includes submitting business documentation and bank account details for settlement.🌟 Step ∞: Go Live! 🚀

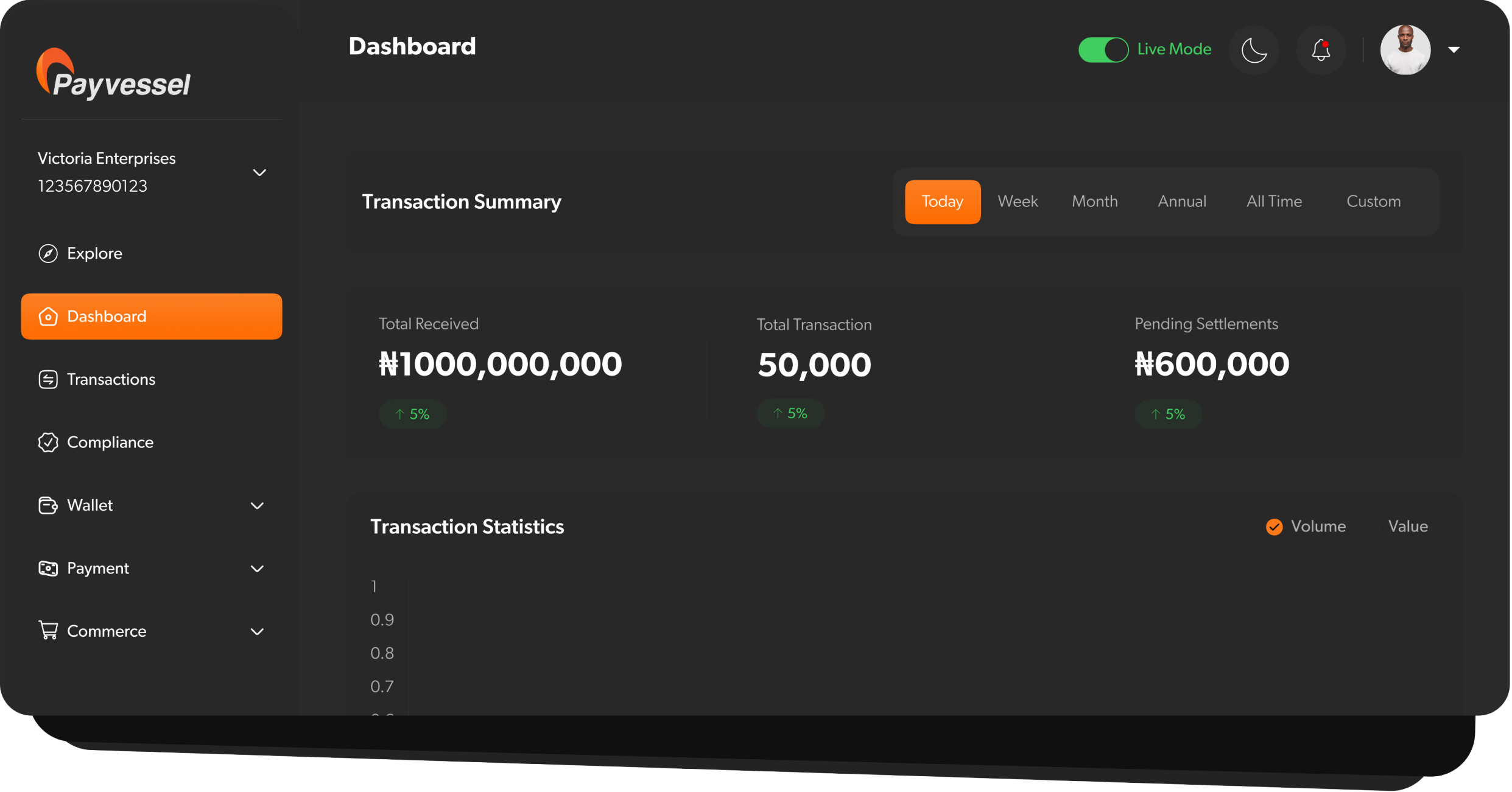

Once verified and approved, you’re ready to navigate live waters! Start accepting real payments in multiple currencies through your Payvessel dashboard.🎯 Explore Dashboard

Discover advanced features and settings unavailable in test mode

✅ Review Integration

Use our go-live checklist to ensure everything is shipshape

🔄 Transfer Configurations

Migrate webhooks, redirect URLs, and security settings

📊 Monitor Performance

Track transactions and optimize your payment flows

Pre-Launch Checklist:

- All sandbox tests passing

- Webhook endpoints configured

- Error handling implemented

- Security best practices followed

- Production credentials updated

🆘 Need Guidance?

Our developer documentation includes detailed tutorials, API references, and troubleshooting guides to ensure smooth sailing throughout your integration journey.📚 Support

Comprehensive API references and guides

💬 Developer Support

Get help from our integration experts

🧪 Testing Tools

Sandbox environment and test utilities

📖 Code Examples

Ready-to-use integration snippets

Ready to begin your payment journey?